Calculate bond yield

In cell A4 enter the formula. The bond duration calculator can be used to calculate the bond duration.

Gcse Ocr Chemistry Chemistry Reaction Balanced Chemical Equation Complete Revision Summary Video Gcse Chemistry Chemical Equation Chemistry Education

Yield spread is the difference between the yield to maturity on different debt instruments.

. The function is generally used to calculate bond yield. Annual coupon rate is 6. The current yield of a bond calculates the rate of return on a bond by using the market price of the bond instead of its face value.

Bond yield is the internal rate of return of the bond cash flows. You calculate current yield by dividing the annual interest earnings by the current market price of the bond 5 110 in this case. The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows which include coupon payments and the par value which is the redemption amount at maturity.

Read more is basically. It is calculated as the annual coupon payment divided by the current market price The current yield is an accurate measure of bond yield as it reflects the market sentiment and investor expectations from the bond. Common examples of yield spreads are g-spread i-spread zero-volatility spread and option-adjusted spread.

As a financial analyst we often calculate the yield on a bond to determine the income that would be generated in a year. Or it can be calculating as the annual return divided by the par value also called the face value of the bond. Plug these figures into the ApproximateYTM formula then solve the equation as you normally would to get your answer.

To get an initial approximation of a semi-annual bond yield one simple method is simply to take the coupon rate on the bond to calculate the semi-annual bond payment and then divide it by the. Example is included to demonstrate how to use the calculator. The nominal yield is the type of bond yield that is used most frequently.

Bond face value is 1000. To use our free Bond Valuation Calculator just enter in the bond face value months until the bonds maturity date the bond coupon rate percentage the current market rate percentage discount rate and then press the calculate button. It is the rate of return that a bondholder earns if he holds the bond till maturity and receive all the.

To calculate the approximate yield to maturity write down the coupon payment the face value of the bond the price paid for the bond and the number of years to maturity. Bond price is 9637. The yield to maturity YTM refers to the rate of interest used to discount future cash flows.

Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. Bond Equivalent Yield - BEY. Based on the above information here are all the components needed in order to calculate the.

Yield is different from the rate of return as the return is the gain already earned while yield is the prospective return. Further still with the same example this 3-year bond is priced at a premium above par value so its yield-to-maturity must be less than 6. Here is an example calculation for the purchase price of a 1000000 face value bond with a 10 year duration and a 6 annual interest rate.

We can now use the financial calculator to find the yield-to-maturity using the following inputs. Yield is 8. Yields are highly dependent on interest rates.

To calculate the current yield of a bond in Microsoft Excel enter the bond value the coupon rate and the bond price into adjacent cells eg A1 through A3. It is simply the coupon rate of the bond. YTM yield to maturity as a decimal multiply it by 100 to convert it to percent M maturity value.

The bond equivalent yield BEY allows fixed-income securities whose payments are not annual to be compared with securities with annual yields. YTM MP 1n - 1. The BEY is a.

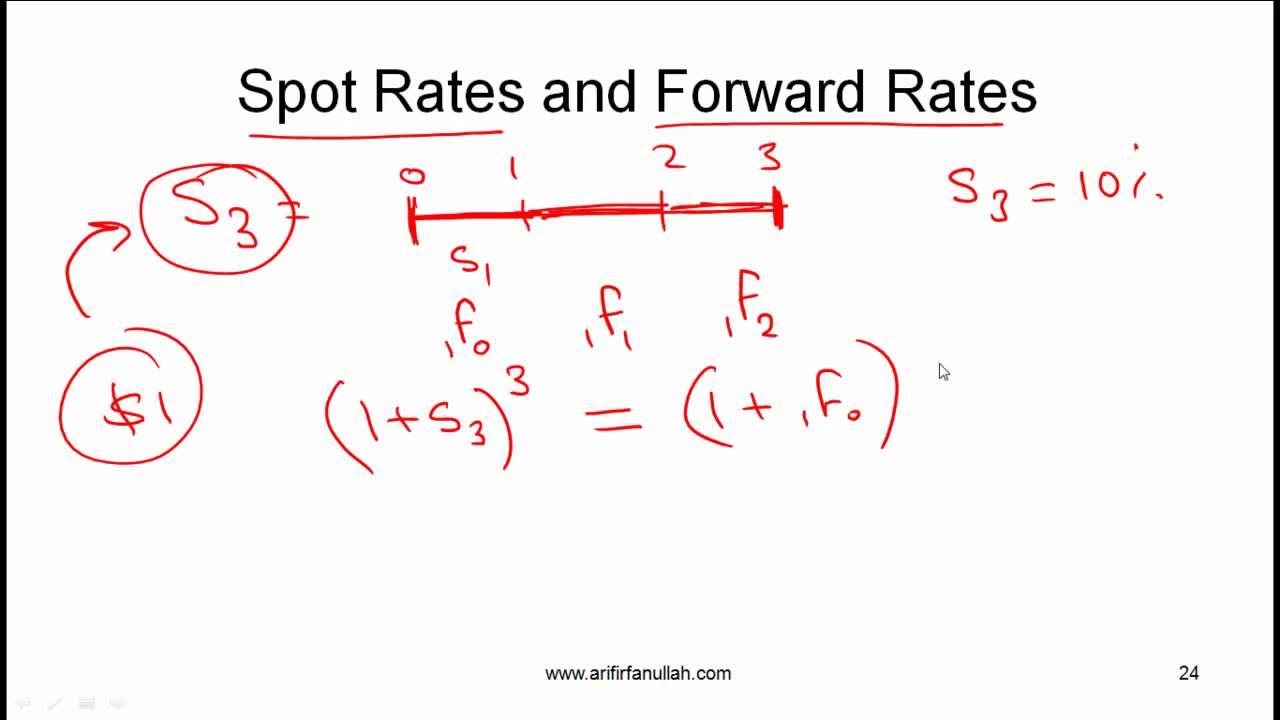

Formula to Calculate Bond Price. PV -10295 Since this is a cash. Calculating the Yield-to-maturity of a Bond using Spot Rates.

Calculate nominal yield. Calculating Yield to Maturity on a Zero-coupon Bond.

How To Calculate Coefficient Of Variation Calculator Standard Deviation Investing

How To Calculate The Annual Rate Of Return On A Bond Our Deer Bond Annual Finance Advice

Microsoft Excel Bond Yield Calculations Microsoft Excel Coupon Template Excel

Bond Yield To Maturity Calculator Printer Driver Organization Development Results Day

Excel Formulas For Accounting And Finance Basic Excel Tutorial Accounting And Finance Excel Formula Excel Tutorials

Pin On Fin

Bond Yield Calculator Online And Free Www Investingcalc Bond Yield Calculator Free Coupon Rate Current Yield Investing Money How To Get Rich Bond

Bond Valuation Calculations Study Guides Finance Quiz Financial Management Finance

The Flippening Is Coming But Not The One You Think Thinking Of You The One One

How To Calculate The Yield Of A Zero Coupon Bond Using Forward Rates Bond Calculator Really Cool Stuff

Pin On Chemistry

Semiannual Coupon Bond Valuation Mgt232 Lecture In Hindi Urdu 10 Youtube Lecture Business Finance Bond

How To Calculate The Molar Mass Of A Compound Quick Easy Youtube In 2022 Molar Mass Molars Chemistry

Pin On Ch 4 Bond Valuation

Bond Yield Calculator 嵐天看投資sky S Views On Investing Smartskyinvest Com 分享投資知識 經驗及交易記錄 股票 債券 房地產投資信託基金 期權sharing Of Investment Knowledge Experience And Transaction Records Stocks Bonds

Yield To Maturity Ytm And Yield To Call Ytc Bbalectures Com Maturity Business Articles Call

Cfa Level I Yield Measures Spot And Forward Rates Video Lecture By Mr Arif Irfanullah Part 5 Youtube Lecture Mr Video